Prepaid Expenses: Definition, Examples & Recording Process

Make the most of your team’s time by automating accounts receivables tasks and using data to drive priority, action, and results. Transform your order-to-cash cycle and speed up your cash application process by instantly matching and accurately applying customer payments to customer invoices in your ERP. Some insurers prefer that insured parties pay on a prepaid schedule such as auto or medical insurance. See the financial statement definition, and study the purpose of financial statements.

Because the income statement reflects business activity over a period of time, this line on your income statement will aggregate any insurance payments your business made during the period that the statement covers. If your policy features an accelerated death benefit, you might be able to receive funds from the policy, as a sort of cash advance, https://kelleysbookkeeping.com/what-are-debtors-and-creditors/ before death to use toward long-term care or end-of-life care. You can also transfer funds from a life insurance policy to an asset-based long-term care policy if you want to buy long-term care insurance. Any situation that requires an honest assessment of your assets requires accounting for any permanent life insurance policies.

Example of Prepaid Insurance

For instance, many auto insurance companies operate under prepaid schedules, so insured parties pay their full premiums for a 12-month period before the coverage actually starts. The same applies to many medical insurance companies—they prefer being paid upfront before they begin coverage. The term prepaid insurance refers to payments that are made by individuals and businesses to their insurers in advance for insurance services or coverage. Premiums are normally paid a full year in advance, but in some cases, they may cover more than 12 months. When they aren’t used up or expired, these payments show up on an insurance company’s balance sheet.

Rather, your balance sheet shows how much money you have left after your insurance expense (and all your other expenses) have been factored into your company’s overall financial position. And accessing the cash value can increase the risk of a potential lapse in coverage. If you are terminally ill, you might be able to sell your policy in a viatical settlement. In this case, a settlement company pays a percentage of the death benefit to buy your policy. You get policy funds to use while you’re still alive, the company gets the death benefit once you pass.

What Are Prepaid Expenses?

Insurance expense is that amount of expenditure paid to acquire an insurance contract. This expense is incurred for all insurance contracts, including property, liability, and medical insurance. The good news for companies about such types of insurance Does Insurance Expense Go On The Balance Sheet? is that they can be deducted from tax liability as a business expense. However, most companies can deduct such expenses on their income tax forms in order to get a tax break. Your assets can fund your goals and provide cash when emergencies arise.

- As the benefits of the good or service are realized over time, the asset’s value is decreased, and the amount is expensed to the income statement.

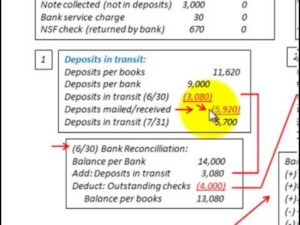

- On December 31, an adjusting entry will show a debit insurance expense for $400—the amount that expired or one-sixth of $2,400—and will credit prepaid insurance for $400.

- If one has sure to keep the documentation ready at his end, he can avail of the insurance.

- If your company has made other prepayments, such as for accounting support or software licenses, your balance sheet will include a line summarizing these prepayments but not specifically naming prepaid insurance expense.